Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods.

Malaysia Import Duties For Motor Vehicles By Building Type 2019 Statista

To calculate the import or export tariff all we need is.

. China HS Code Directory tree lookup General Trade Tariff Customs Requirements China Import Duty for Free Trade Conventional Country. Every country is different and to ship to Malaysia you need to be aware of the following. Malaysia to Malaysia Dimension of 10x10x10 cm.

For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent considerably higher effective tariff rates. Tariffs and non-tariff barriers Tariff. These taxes are also one of the highest in the world.

However the average duty paid on industrial goods imported into Malaysia is 61 percent. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. Malaysia - Import Tariffs.

Malaysia levies a tariff rate which ranges from 0 to 50 percent following ad valorem rates. Merchandise trade and tariff statistics data for Malaysia MYS imports from partner countries including trade value number of products Partner share Share in total products MFN and Effectively Applied Tariffs duty free imports dutiable imports and free lines and number of trade agreements for year 2019. Malaysia tariff rates for 2013 was 444 a 003 increase from 2012.

The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities. Trying to get tariff data. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

Malaysia - Import Tariffs. If there is no duty rates indicated mean this goods is not in the list of free trade agreements for that country it is applicable to the most favored nation tariff rates. Why Sellers use Our Services.

Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. These local manufacturers are Proton and Perodua. Start Shipping To Malaysia With Confidence.

Import Tariffs and Taxes. Egg in the shells. Malaysia tariff rates for 2014 was 128 a 316 decline from 2013.

Apply For Excise Duty Credit And Drawback. For certain goods such as alcohol wine poultry and pork Malaysia charges specific duties that represent extremely high effective tariff rates. Last published date.

United States to Malaysia Dimension of 4x4x4 in. These excise duties imposed on foreign manufactured cars have made them very expensive for consumers in Malaysia. For certain goods such as alcohol wine poultry and.

Malaysia Part A1 Tariffs and imports. Live animals-primates including ape monkey lemur galago potto and others. Start Shipping To Malaysia With Confidence.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. TARIFF SCHEDULE OF MALAYSIA Tariff schedules and appendices are subject to legal review transposition and verification by the Parties.

Duties for tariff lines where there is. Malaysia adopts the Harmonized Commodity Description and Coding System of classification of goods. Shipping Rates Based On.

What is Excise Duty. Firms should be aware of when exporting to the market. Malaysian customs apply higher tariff rates to goods in which considerable production already exists domestically as well as so-called.

Malaysia - Import Tariffs Malaysia - Import Tariffs Includes information on average tariff rates and types that US. This makes most foreign cars extremely expensive for buyers although cheaper in other countries. The value of your order.

Firms should be aware of when exporting to the market. Tatacara Permohonan Lesen Vape. Summary and duty ranges Total Ag Non-Ag WTO member since 1995 Simple average final bound 209 536 149 Total 843.

Tips on how to Sell Internationally. Calculate import duty and taxes in the web-based calculator. Tariff lines and import values in Fruit vegetables plants Coffee tea Cereals.

Every country is different and to ship to Malaysia you need to be aware of the following. Shipping Rates Based On. Includes information on average tariff rates and types that US.

Its fast and free to try and covers over 100 destinations worldwide. Up to 2 cash back When shipping a package internationally from United States your shipment may be subject to a custom duty and import tax. When the effectively applied rate is unavailable the most favored nation rate is used instead.

Malaysia tariff rates for 2016 was 402 a 274 increase from 2014. The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Firms should be aware of when exporting to the market.

Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. Malaysia import and export customs duty rates calculator. Includes information on average tariff rates and types that US.

Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Tariff schedule of malaysia Tariff schedules and appendices are subject to legal review transposition and verification by the Parties. And the Freight insurance cost.

Up to 2 cash back When shipping a package internationally from Malaysia your shipment may be subject to a custom duty and import tax. Malaysia is progressively liberalising its tariff regime but some products that are in competition with locally-manufactured products are still highly protected.

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

Import Duty And Sales Tax Exemption On Imported

Collect Duties Delight Globally 2022 Shopify New Zealand

Govt S 10 Percent Customs Duty Proposal Sparks Debate Kuensel Online

Govt Proposes Reducing Customs Duty To 10 Percent Opposition Criticises Kuensel Online

Anti Dumping Duty Likely On Black Toner In Powder Form From China Others Photo Printer Printer Mobile Print

Customs Duties Services Services Indirect Tax Deloitte Japan Tohmatsu Customs Duty Customs Duty Reduction Customs Valuation Tariff Classification Customs Audit Fta Epa Trade Control Supply Chain

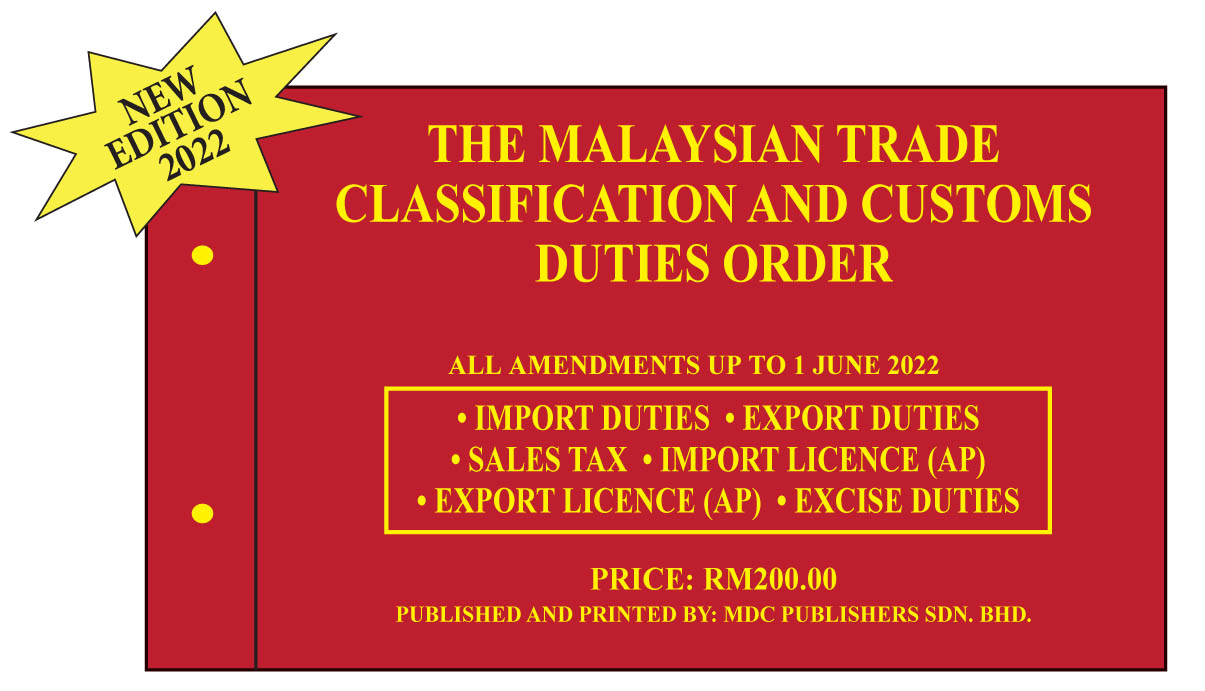

Bestseller The Malaysian Trade Classification And Customs Duties Order 2022

How To Calculate Uk Import Duty And Taxes Simplyduty

Customs Duties Some History Some Applications

![]()

How To Save On Import Duties 7 Money Saving Tips Opas

India Reviews Measures To Restrict Imports From China It Is Dusting Up By Raising Basic Customs Duties On Multipl Import From China New Chinese Chinese Export

Import Duties On Non Eu Bicycles

Anyone Kena 20 Import Duty Tax While Receiving Goods From Oversea R Malaysia

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

Import Duty Malaysia Clearance 55 Off Www Colegiogamarra Com

![]()

The Ultimate Guide To Import Custom Duty Icontainers

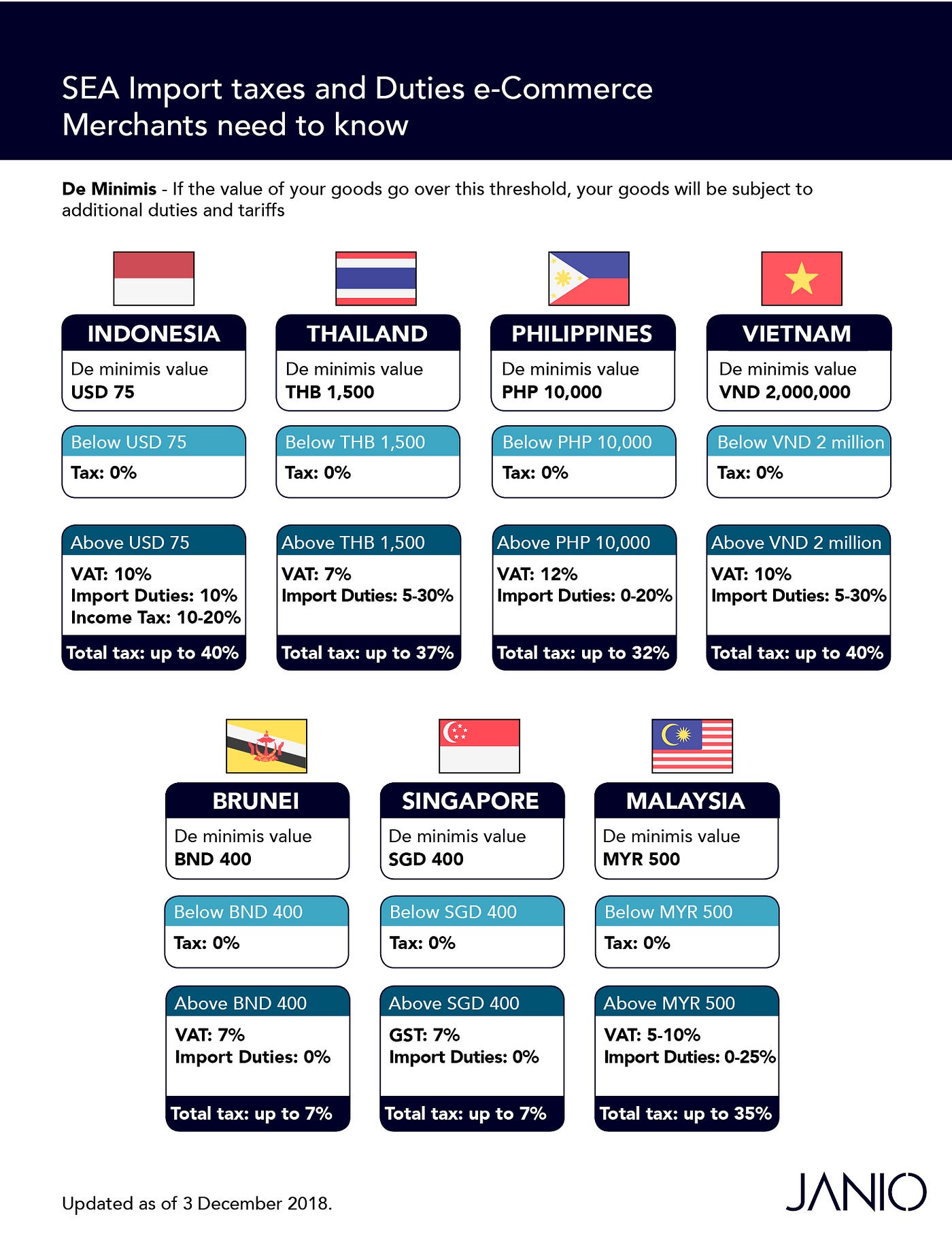

Customs Clearance In Southeast Asia Guide For B2c E Commerce Business By Janio Content Team Janio Asia Medium