For further information consult the dedicated page on the official website of. Meanwhile for the B form resident individuals who carry on business the deadline is.

Tax Filing Deadline 2022 Malaysia

Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident individuals who carry on a business.

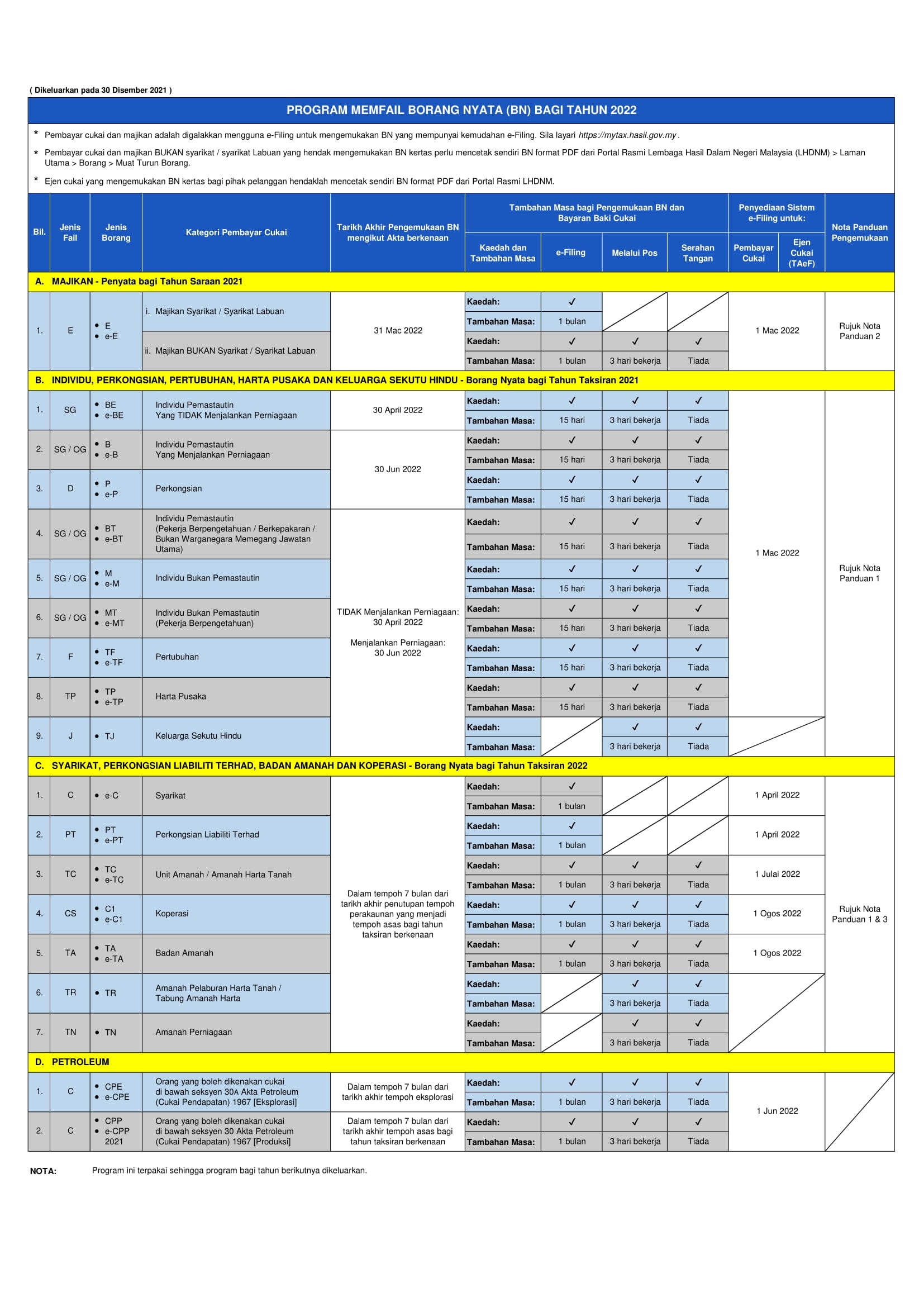

. Foreign income remitted into Malaysia is exempted from tax. All Income Tax Return Forms must be submitted within 30 days from the date stated on the form or for period that has been set by the government. KUALA LUMPUR April 14 The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing.

In a statement today IRB also advised taxpayers to submit the Tax Return Form and pay their income tax within the stipulated. The Inland Revenue Board IRB says that the deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e-Filing. The penalty will be imposed if there is a delay in the submission of your Income Tax Return Form.

Malaysia has implementing territorial tax system. The tax submission deadline under ITA is usually within 7 months after the end of accounting period. Tax Deadline 2022 Landing CN Advisory 2022 tax filing deadlines PERSONAL TAX Form BE 30 April 2022 SOLE PROPRIETOR Form B PARTNERSHIP Form P 30 June 2022 SDN BHD Form C 7 months after financial year end Penalties up to.

You can see the full amended schedule for income tax returns filing on the LHDN website. According to section 83 1a income tax act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration form ea of that employee on or before the last day of february in the year immediately following the first mentioned yearan employee can have more than one form ea in a year in the case of. For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing.

Deceased persons estate Association. Semporna 30 Jun 2022 Pembelajaran murid Sekolah Kebangsaan Mabul diperkasakan menerusi Program HASiL Kasih Prihatin 2022 anjuran Lembaga Hasil Dalam Negeri Malaysia HASiL. On the First 5000.

If youre a very busy person or if this is your first time doing this you might just forget to fill up that LHDN form on timePlease note that the deadlines for tax filing are 30th April 2022 and 15th May 2022 for manual filing and e-Filing respectively. Form B-personal business clubs etc. 7 months after financial year end 8 months for e-filing.

This method of e-filing is becoming popular among taxpayers for its simplicity and user-friendliness. On the First 5000 Next 15000. Other entities Submission of income tax return.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Taxpayers can start submitting their income tax return forms through the e-Filing system starting from March 1 of every year unless otherwise announced by LHDN. Form P-Partnership Business-Before June 30.

For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022. March 11 2022 Image source. For further information kindly refer the Return Form RF Program on the IRBM Official Portal.

By 30 April without business income or 30 June with business income in the year following that YA. The deadline to submit the Tax Return Form for the Year of Assessment 2021 non-business income is on April 30 for manual submissions and May 15 via e. According to Section 83 1A Income Tax Act 1967 that every employer shall for each year prepare and render to his employee statement of remuneration Form EA of that employee on or before the last day of February in the year immediately following the first mentioned year.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Form BE-personal income from part-time work no business. The following are the deadlines for tax filing.

Both residents and non-residents are taxed on income accruing in or derived from Malaysia. Calculations RM Rate TaxRM A. -Before April 30 3.

Employment income BE Form on or before 30thApril Business income B Form on or before 30thJune ONLINE Employment income e-BE on or before 15thMay Business income e-B on or before 15thJuly Date of online submission may subject to change. According to the BE form resident people who do not engage in business the deadline for reporting income tax in Malaysia for manual filing in. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

PEMBELAJARAN MURID SEKOLAH KEBANGSAAN MABUL DIPERKASA MENERUSI PROGRAM HASiL KASIH PRIHATIN 2022. By 31 March of the following year. Before June 30 4.

The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income. Form E-The company reports the total annual salary of its employees to the government. Keep all your receipts.

For Labuan entities taxed under the Malaysia Income Tax Act 1967 ITA the 3-months extension only applies to taxpayers whose accounting period ended on 30 November 2020 and 31 December 2020. -Before March 31 2.

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Business Income Tax Malaysia Deadlines For 2021

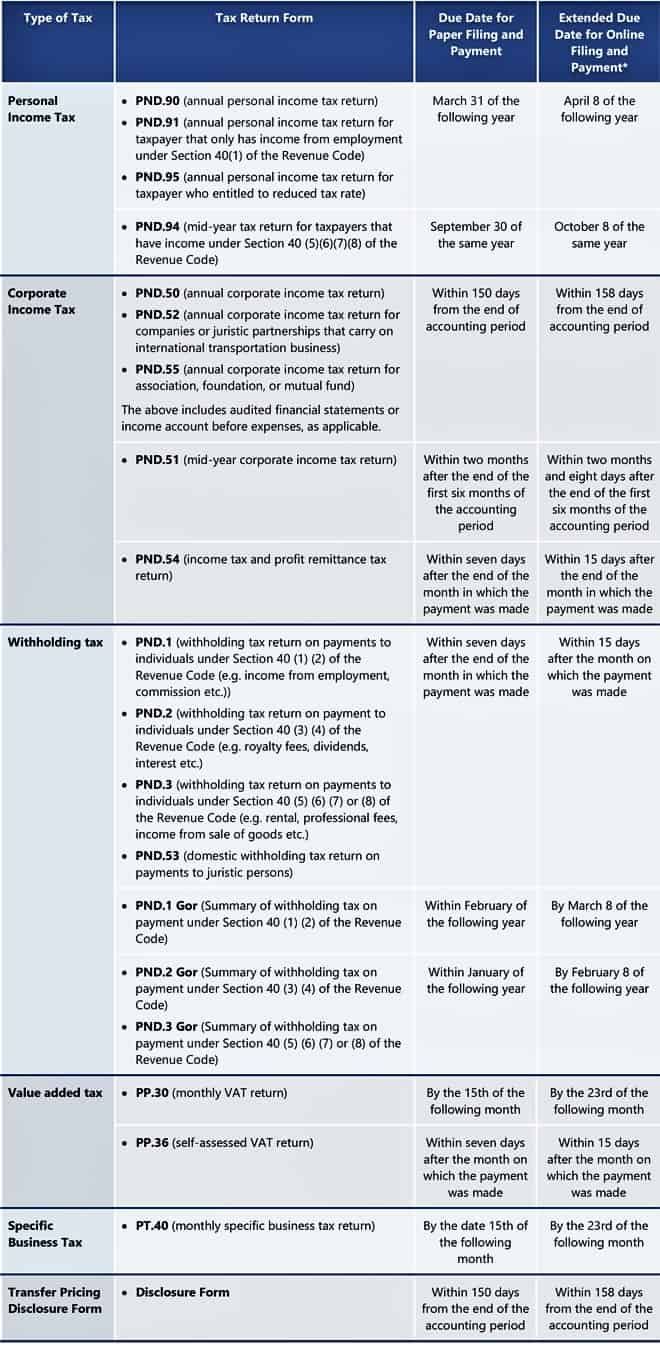

Further Extension For E Tax Filing And Payment In Thailand Income Tax Thailand

Malaysia Personal Income Tax Guide 2021 Ya 2020

View Full Version Here Http Www Imoney My Articles Bankruptcy Infographic Bankruptcy Reality Check

Business Income Tax Malaysia Deadlines For 2021

Important Dates For 2022 Tax Returns Leh Leo Radio News